Monetization in 2025 varies dramatically across platforms, countries, and niches. YouTube delivers the highest payouts, TikTok offers low RPM, and X remains unstable. This guide brings together all key factors creators need to understand to maximize their earnings.

The creator economy in 2025 is bigger than ever, yet actual monetization still varies widely depending on the platform, the audience location, the niche, and the rules required to start earning. Many creators focus on view counts alone, but real income depends on a much more complex mix of factors. This guide brings together all major factors and provides a full overview of monetization across platforms, sectors, and regions.

Platform-Based Monetization in 2025

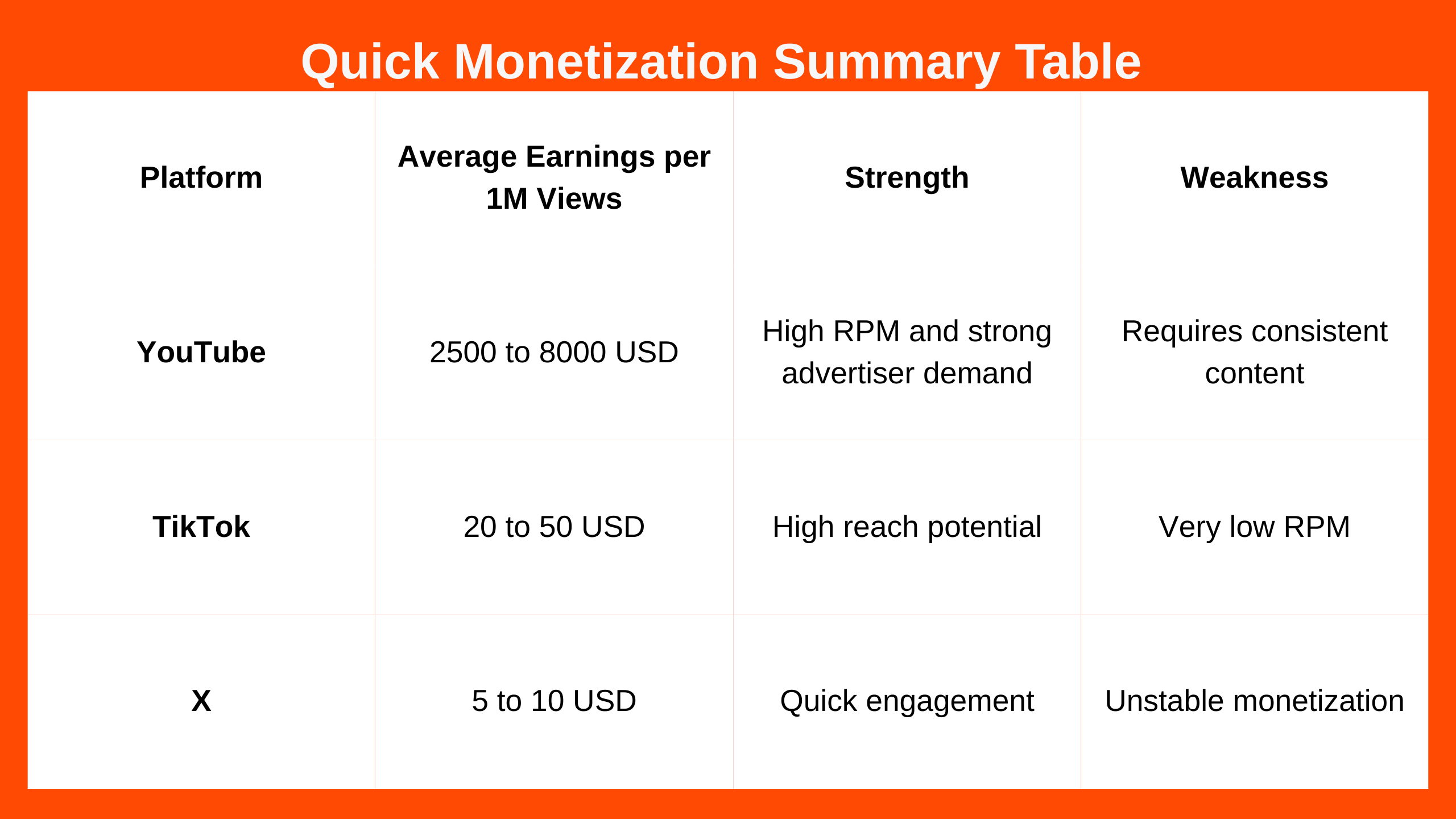

Each platform pays creators differently because advertising systems, viewer behavior, and content formats vary widely. Although none of the major platforms publish fixed earnings per million views, creator data shows clear average ranges.

YouTube remains the most profitable one. Most creators earn between 2500 and 8000 dollars for one million views, and the amount can exceed 10 thousand dollars in high-value niches. TikTok provides massive reach but pays much less, with around 20 to 50 dollars per million views. X has the lowest payout structure, where earnings often fall between 5 and 10 dollars per million impressions.

Country-Based Monetization Differences

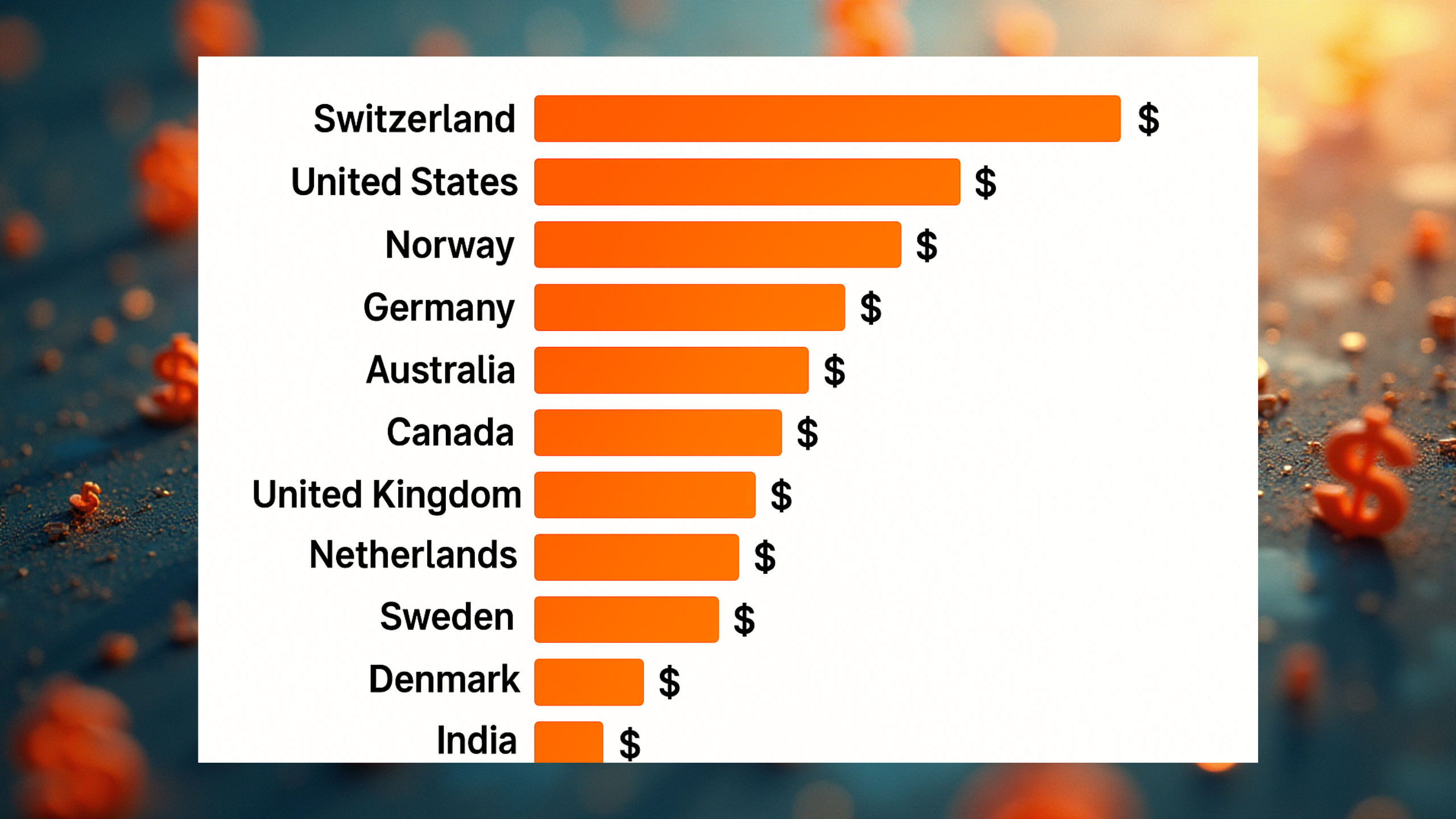

After understanding the platform gap, it becomes essential to examine audience geography. CPM levels depend heavily on a country’s economic environment and advertiser spending. High-paying regions include the United States, Canada, the United Kingdom, Germany, Australia, and Switzerland. Low-paying regions include India, Pakistan, Indonesia, the Philippines, and most of South America.

The same video can earn several times more or several times less depending on the country that views come from. This difference affects YouTube, TikTok, and X alike.

Niche-Based Monetization Differences

Niche determines advertiser value. Premium niches attract companies willing to pay more for targeted audiences.

- Finance

- Business and entrepreneurship

- Technology and software

- Education

- Health

These niches typically generate the highest CPM. Meanwhile, lifestyle, entertainment, general vlogs, memes, and dance content earn considerably less. These niche differences explain why creators with similar view counts can earn completely different amounts across social media platforms.

Industry-Specific Earnings for Creators

Sector-based earnings reveal another important layer in monetization. On average in 2025, creators earn:

- Finance creators earn between 8000 and 15000 USD

- Tech creators earn between 4000 and 10000 USD

- Business creators earn around 5000 to 8000 USD

- Education creators earn between 2000 and 6000 USD

- Lifestyle creators earn around 1000 to 3000 USD

- Entertainment creators earn between 800 and 2000 USD

- Gaming creators earn between 500 and 2000 USD

These ranges reflect mostly YouTube earnings. TikTok and X pay many times less, even within high-paying sectors.

Earnings Per View and Why They Vary

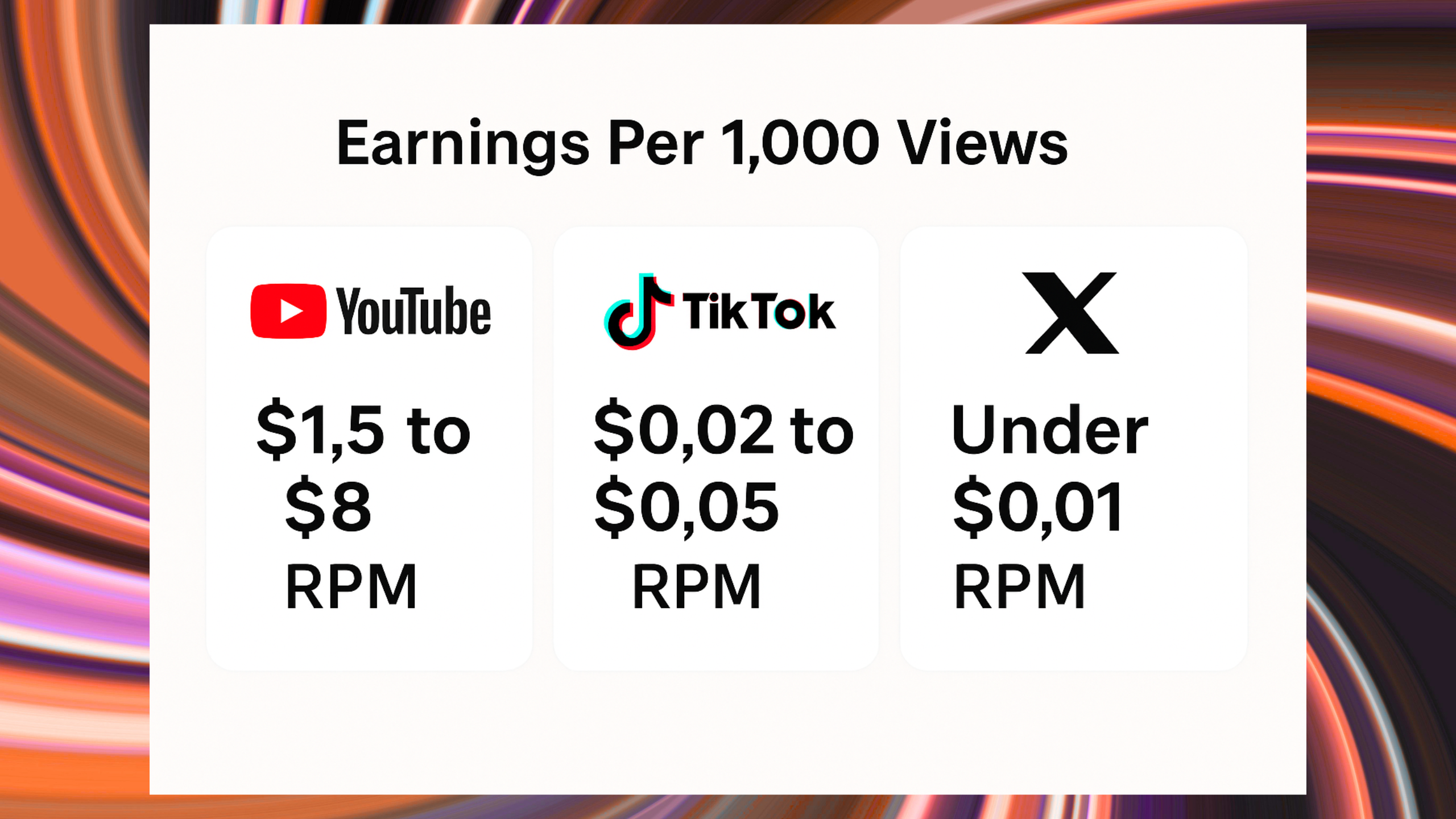

All these differences stem from CPM and RPM values. CPM shows what advertisers pay per thousand views, while RPM reflects what creators actually receive after deductions.

YouTube offers RPM values that typically range from 1.5 to 8 dollars. TikTok remains much lower at around 0.02 to 0.05 dollars per thousand views. X usually pays under 0.01 dollars due to its premium-based system.

Short-form content on YouTube Shorts also contribute to earnings, but generally at lower RPM levels than long-form videos.

Monetization Requirements for Each Platform

Each platform has its own set of rules creators must meet before earning money. YouTube requires one thousand subscribers and either four thousand watch hours in twelve months or ten million Shorts views in ninety days. TikTok evaluates engagement, originality, region, and platform compliance through its Creator Rewards system. X requires a Premium or Premium Plus membership along with at least five million impressions in the past three months.

Once these requirements are met, creators gain access to each platform’s monetization structure.

Overall Insight and Strategic Takeaway

When platform differences, country dynamics, niche variation, and monetization requirements are all evaluated together, one pattern becomes clear. YouTube stands out as the most profitable platform for creators who aim for sustainable earnings. TikTok provides viral reach but low payouts, and X offers minimal monetary gain despite high engagement potential.

Creators planning for long-term growth should choose their niche and target audience with monetization value in mind. Selecting the right platform is equally important to ensure that view counts turn into real income.

FAQs

What platform pays the most for one million views?

YouTube pays the most, with 2500 to 8000 dollars on average and even more for premium niches.

Which niche earns the most money?

Finance and technology are the highest-earning niches due to strong advertiser competition.

Why does X have the lowest payouts?

X depends heavily on Premium user engagement, which limits revenue opportunities and creates unstable payouts.

Does long-form content earn more than short-form content?

Yes. Long-form content generally produces more ad inventory and therefore higher RPM.

Can creators in low CPM countries still earn well?

Yes, but they need high-value niches or global audiences from high-paying regions.